Financial Data Aggregation

20+ years aggregating custodians and alternative investments, bringing a consolidated total wealth view

We offer unified tech-based solutions to aggregate all investment data into a single and consolidated solution. Our unique one-time LOA process further distinguishes PCR financial aggregation, allowing us to coordinate collections with custodians and alternative managers, taking this responsibility off your hands.

About Us

Financial Data Aggregation for Custodians, Alternative Investments, and Illiquid assets

Our unified technology and operations ensure efficiency, data quality, and completeness of investment data across all asset classes. We offer a one-stop solution for streamlined consolidated investment reporting.

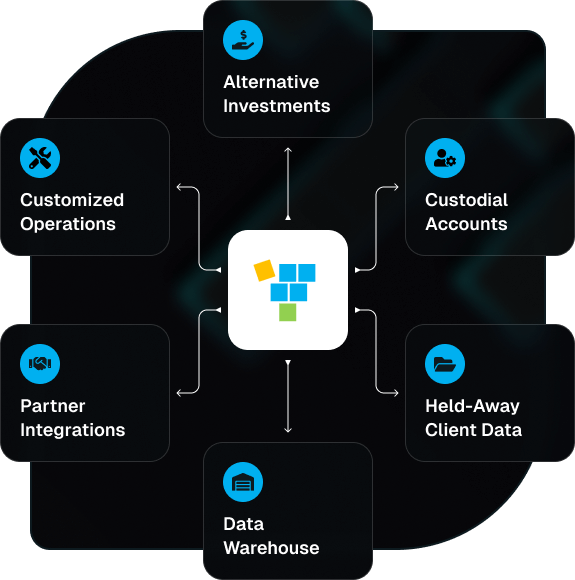

Seamless Financial Data Aggregation Platform

Assisting Firms to Increase Focus on Investment Practice

PCR empowers firms to concentrate on what matters most—your clients' portfolios. Through our PCR financial aggregation and financial data aggregation solutions, we handle all data aggregation needs including manual tasks such as manual brokerage statements, capital calls/distributions notices, and hard to track assets. Streamline your processes for improved efficiency and greater data accuracy.

Alts Investment Data Aggregation

Financial Efficiency & Accuracy Delivered

Implement a customizable technology-driven managed service to replace manual processing. Through PCR financial aggregation and financial data aggregation solutions, PCR is designated as an interested party to Alternative Managers, enabling direct access to portals and email communication for efficient processing of capital calls, distribution notices, and valuations.

- Harvest

- Convert

- Validate

- Recon

- Publish

Harvest

PCR has developed automated harvesting technologies that collect information from thousands of alternative managers. The technology provides consent, collection of documents from emails and portals, identification of document type and registered account association. Where technology cannot acquire documents, our team manually get the required information.

Convert

We then convert the collected information into the standardized or approved format for easy deployment.

PCR technology integrates various technologies to efficiently and accurately extract pertinent transaction data from documents, utilizing OCR and NLP powered by AI and machine learning. Workflows also ensure that if our machines require assistance, our teams step in to provide the highest quality data.

Validate

PCR alternative aggregation services utilize our global transaction processing, reconciliation, and quality control framework to guarantee that only precise data is delivered to clients' systems. Our data operations team monitors any reported deviations and resolves them promptly.

Recon

Once validated, the data goes through a rigorous reconciliation process, which involves multiple stages of cross-checking and verification to ensure accuracy and consistency, just as all investment data must undergo to maintain the highest standards of financial integrity.

Publish

This is the final phase, where the harvest data, following comprehensive analysis and monitoring, is made available in the preferred format for clients' access.

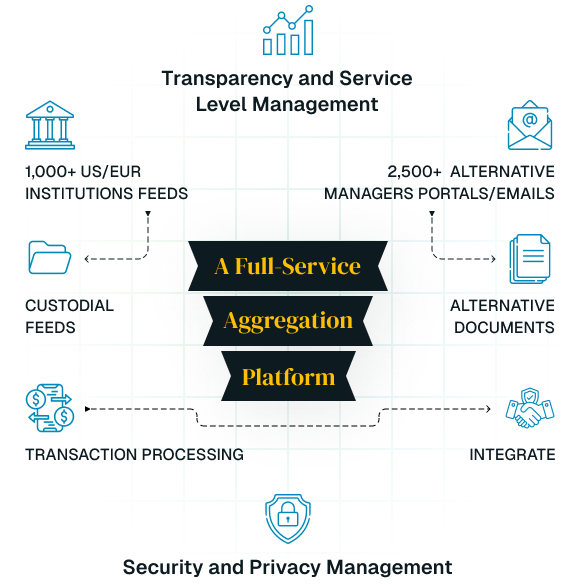

Our transparency portal and operational workflows enable real-time tracking of every document, projected statements, document processing accuracy, and tools for secure collaboration on any issues. Service levels for accuracy, timeliness, completeness, and responsiveness are reported in real-time.

Custodial Data Aggregation into Reporting Systems

Collect and convert clients’ financial data from global banking and custodian accounts into reporting and analytics systems. PCR interacts daily with over 1,000 custodians worldwide, processing transactions, positions, tax lots, accounts, and security master information overnight for T+1 data uploads. Additionally, PCR is equipped to manually process brokerage statements in the absence of a data feed. Contact us to check if we cover your custodians.

- Data Streamlined: Tech-driven solutions offer a robust stream of data from various sources.

- Eliminating inefficiencies: By eliminating human touchpoints at all stages, we eliminate possible inefficiencies caused by human error.

- Consolidated Portfolio Reporting: We provide bespoke consolidated portfolio reporting on your preferred platforms.

End-to-End Financial Data Solutions

Platform

Experience the tech-driven financial data management that covers data processing, collection, and publishing. Eliminate any inefficiencies and enjoy accuracy in data.

-

Financial Data AggregationPCR offers robust financial solutions that assist in management, reporting, and bespoke solutions to meet all unique needs.

Financial Data AggregationPCR offers robust financial solutions that assist in management, reporting, and bespoke solutions to meet all unique needs. -

Bespoke Portfolio ReportingWe extend our aggregation to consolidated portfolio reporting, which provides customized reporting on your preferred platform.

Bespoke Portfolio ReportingWe extend our aggregation to consolidated portfolio reporting, which provides customized reporting on your preferred platform.

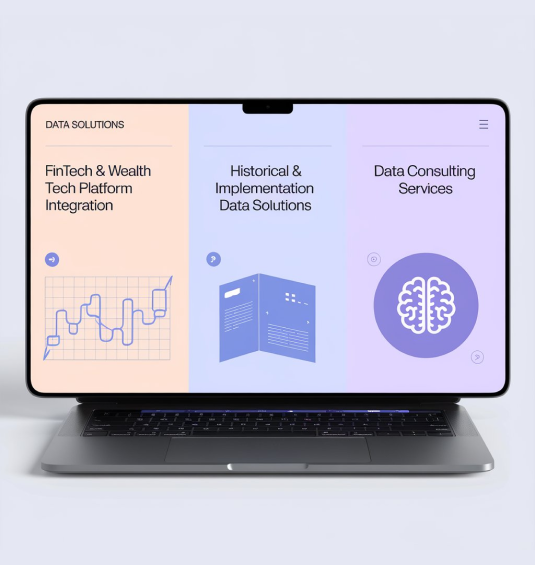

Data Solutions

Contact our data solutions service when collecting, gathering, and integrating data from various sources becomes troublesome. PCR offers a comprehensive data management solution to streamline and enhance data management.

-

Fintech & Wealth Tech Platform IntegrationThis service is best suited for those offering fintech and wealth tech solutions. We help integrate the data into your preferred format.

Fintech & Wealth Tech Platform IntegrationThis service is best suited for those offering fintech and wealth tech solutions. We help integrate the data into your preferred format. -

Historical & Implementation Data SolutionsStore all your historical data perfectly and concisely for smooth and easy access anytime.

Historical & Implementation Data SolutionsStore all your historical data perfectly and concisely for smooth and easy access anytime. -

Data Consulting ServicesHarness the power of data through our data consulting services. Our team of experts presents data to assist you in making a well-informed financial decision.

Data Consulting ServicesHarness the power of data through our data consulting services. Our team of experts presents data to assist you in making a well-informed financial decision.

Wealth Owners

We provide multiple customized services for wealth owners to help them achieve seamless wealth management. This includes -

- SFOs & MFOs: Tailored solutions for individual family offices and Multi-Family Offices providing end to end platform for financial aggregation and consolidated reporting of all assets.

- RIAs & Wealth Advisors: Aggregation service of all custodians, Alternative Investments, hard to track assets and providing an integration with any in-house or 3rd party reporting platforms.

Tech-based Solutions

We empower Wealth Tech platforms and Service Providers with seamless data aggregation and automated reporting solutions. Our secure and integrated platform helps streamline operations, enhance client satisfaction, and drive operational efficiency. Click here to learn more about how to partner with us.

.png?width=575&height=380&name=Untitled%20design%20(19).png)

Enterprise

We extend our aggregation support services to large banks and financial institutions handling their clients' financial reports. We help them gather all the data from various sources and present it to their customer on one platform.

.png?width=575&height=380&name=Untitled%20design%20(20).png)

Experience PCR’s Solutions

Are you wondering how PCR Financial Aggregation helps with tech-based solutions? Schedule a demo and explore the solution yourself. Discover the features and benefit from tailored needs.

Why Choose Us

We are partnered with top financial tech firms to enhance our solutions, providing seamless solutions to our clients.

-

Experience

20 + years of experience in financial data management

-

Technology

State-of-the-art technology for seamless data integration

-

Accuracy

Rigorous quality control ensures highest data accuracy

-

Support

A dedicated team that understands your business

-

Customization

A tailor-made solution to meet all your business needs

Success Stories from Our Clients

Wondering how PCR can help you? Check out our success stories in financial data management and reporting.

Global Private Bank

A leading global private bank sought a solution to streamline its data aggregation and reporting processes.

- Efficiency: Reduced data processing time by 50%.

- Accuracy: Achieved near-perfect accuracy in financial reports.

- Client Satisfaction: Enhanced client satisfaction through timely and precise reporting.

Collaboration with Industry Leaders

We partner with leading financial technology companies to streamline and enhance financial data aggregation solutions, ensuring seamless integration and superior value to our clients.

Get Ready to Transform Your Financial Data Management

Contact us to learn more about our solution and how we can help you streamline your process and elevate your reporting capabilities.