Strengthen Trust and Transparency with PCR Data Aggregation Solution

PCR offers Family Offices, Wealth Advisors, and Asset Allocators a comprehensive solution for consolidating clients' assets and generating detailed asset reports. Your team will have the freedom to focus on what truly matters—effective asset management.

Comprehensive Data Aggregation and Managed Services for Personal Financial Management and Family Offices

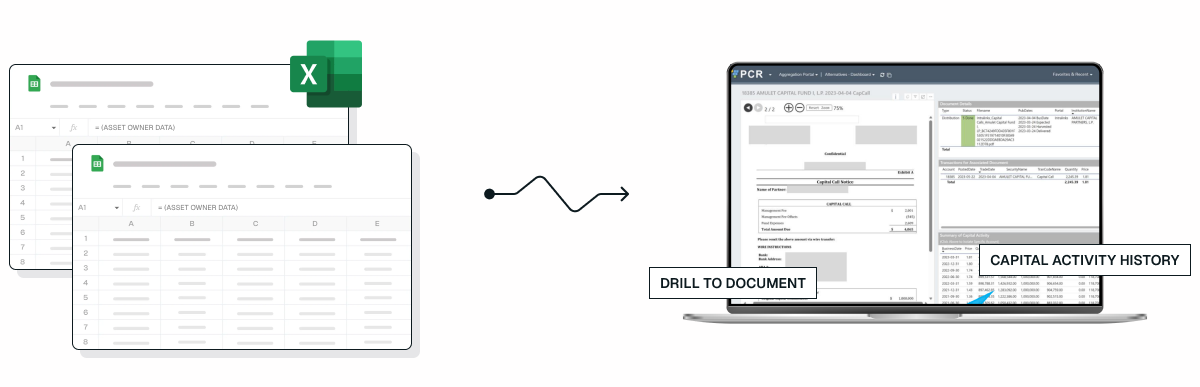

The PCR platform and its aggregation services enable you to consolidate positions and underlying transaction data seamlessly. With integrations to leading RIA tech platforms like Addepar, Tamarac, Solovis, Asset Vantage, Allvue, HWA, and Confluence, managing your assets becomes streamlined and efficient, supporting both family office solutions and personal financial management.

Our one-time LOA process simplifies data and document collection, positioning PCR as a key participant in the data collection process with counterparties. We actively follow up and coordinate with these counterparties to ensure that your data is complete and timely, supporting RIA tech needs and family office solutions. This guarantees that your reporting remains up-to-date at all times, allowing you to focus on strategic decision-making while we handle the complexities of data management.

-

Transparency

-

Make An Informed Decision

-

Bespoke Reporting

Transparency

We create greater transparency by centralizing the family office’s financial information in a single place. Our family office solutions provide a complete view of all accounts and assets, regardless of the asset class, legal entity, or currency.

Make An Informed Decision

Analyze and visualize your portfolio data via our effective representation of your asset data. The immediate assessment helps you identify the risk and transform insight into action. A clear and concise representation of the data enables you to analyze minor transactions or across the most complex portfolio within seconds.

Bespoke Reporting

We provide flexible reporting that empowers you to create customized reporting that is updated daily. Get efficiently created multigenerational reports that can strengthen your family communications around wealth transfer and preservation.

Strengthening the Foundation of RIA &

Wealth Advisors

We understand that Registered Investment Advisors (RIAs) require accurate, daily, enriched, and reconciled data from both home and held-away custodians.

PCR can assist you in two key ways:

- Primary Offering: Our data aggregation service ensures your platform is continuously updated with normalized, enriched, and reconciled data.

- Extended Offering: With our robust data aggregation infrastructure, you can utilize our expertise or let us manage your data feed operations from your preferred custodians, supporting the needs of RIA tech platforms.

Our capabilities include:

- ETL/Scheduler Infrastructure: Efficiently coordinating and collecting custodian data, supporting family office solutions with seamless data processing.

- Expertise in Leading Platforms: Integrating data into top RIA tech platforms like Addepar, Tamarac, and Solovis for enhanced personal financial management.

- Time Zone Coverage: Our global operations ensure custodian data is collected overnight, ready for your day.

We support over 1,000 custodians, enabling effective data feeds into any aggregation platform. With PCR, you can focus on delivering exceptional service to your clients while we expertly handle your data management needs.

Assisting Institutional Asset Allocators

As an institutional allocator—whether an endowment, pension fund, foundation, corporate entity, or fund of funds—high standards of service level agreements (SLAs) are essential for accuracy, timeliness, and completeness. These standards help meet compliance requirements and support accounting, risk, and reporting platforms, aligning with our comprehensive family office solutions.

We understand that pension funds require the aggregation of both defined contribution (DC) and defined benefit (DB) data, whether by converting statements into actionable data or receiving it directly from record keepers.

Our capabilities include:

- Primary Offering: Our Data Aggregation and Managed Data Services provide comprehensive support similar to that for family office solutions, handling the entire process through a one-time LOA for efficient data collection and monitoring.

- Extended Offering: This hybrid model combines custodian data aggregation with document collection for alternative positions, supporting RIA tech needs and enhancing personal financial management capabilities. This ensures your institution meets its data management needs while focusing on core objectives.

-

Comprehensive Portfolio

-

Analytics & Risk Management

-

Automation & Integration

-

Inspection Round

Comprehensive Portfolio

We provide a single, centralized platform that aggregates data from various sources, including investment managers, custodians, and alternative asset managers, offering a holistic view of portfolio performance

Analytics & Risk Management

Our tool allows allocators to analyze portfolio performance, asset allocation, and risk exposure in depth. The report helps to analyze the details, evaluate diversification, and identify potential vulnerabilities. This allows them to make necessary adjustments to avoid any future risk.

Automation & Integration

We can integrate our solution with more than 20 platforms, allowing you to view the report on your preferred platform without any hindrance. This integration minimizes the manual data entry and reconciliation process, thus eliminating errors and improving operational efficiency.

Bespoke Reporting

We offer a customizable reporting solution to meet all your specific requirements, supporting personal financial management needs. The flexible reporting capabilities automatically update, thus providing you with real-time reporting. The visually compelling reports assist stakeholders in understanding complex investment decisions easily and improve trust and transparency.

Empower Your Asset Management Today

Ready to enhance trust and transparency in managing your clients’ assets? Our asset management solution offers seamless reporting and robust data insights to support family office solutions and personal financial management needs, helping you grow and protect wealth. Take the next step toward smarter asset allocation.