Streamline Your Wealth Management and Consolidated Financial Reporting With Our Platform

We offer two platforms - Financial Data Aggregation and Bespoke Consolidated Financial Reporting, to ease complex financial management and simplify your financial data to make an informed decision.

Why Choose Our Platform?

Explore the features that make our platform a trusted solution for managing financial data and enhancing portfolio reporting.

Financial Data Aggregation

Simplifying Your Financial Management

Managing multiple accounts for individuals and businesses can be challenging in today's complex financial landscape. We offer a financial data aggregation platform that consolidates information from various financial institutions into a comprehensive view. This holistic perspective empowers you to make informed decisions, track financial performance, and identify growth opportunities.

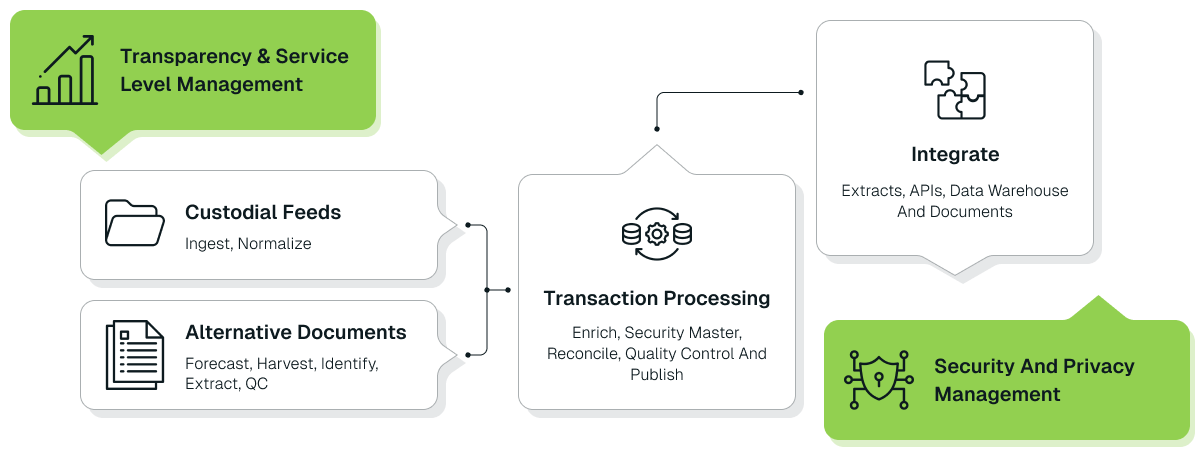

We are the only institution that encompasses data and documents across liquid investments (custodian and bank accounts), illiquid investments (alternative assets), and real assets (such as wine collections, art, and real estate). We deliver a single, normalized, enriched, and reconciled dataset that can be seamlessly integrated and uploaded into your client reporting, accounting, performance, or compliance platforms, supporting consolidated financial reporting and wealth management reporting requirements.

Consolidated Financial Reporting

Empowering Informed Financial Decisions

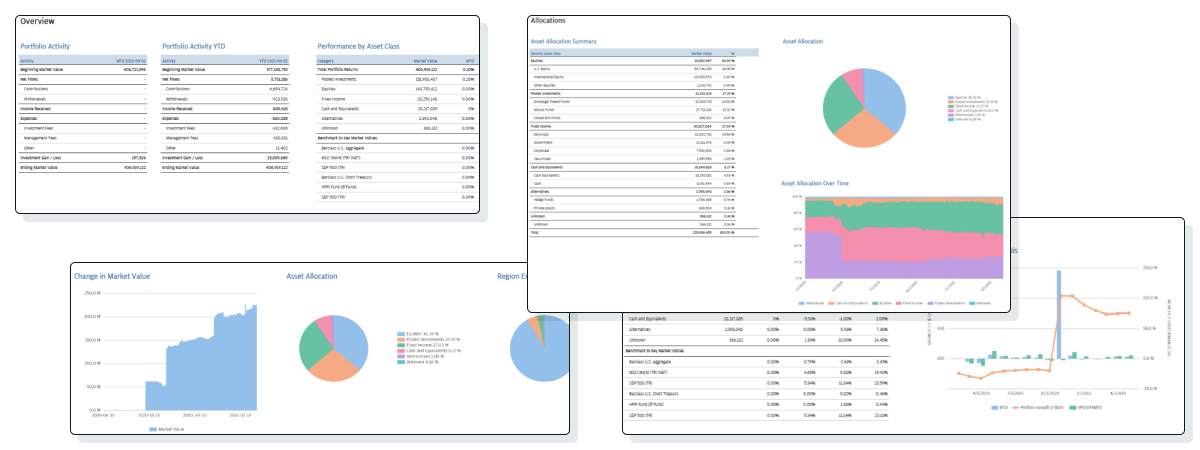

A clear and concise portfolio view can help you make informed decisions regarding your financial goals. Our platform offers a tailored solution that moves beyond the traditional reporting method and provides a holistic and personalized view of your financial investments, specifically designed to enhance consolidated financial reporting for a complete, accurate, and actionable perspective.

- Customized View

- Consolidated Report

- Performance Analysis

- Risk Assessment

Customized View

We acknowledge that every business and individual has personal financial goals. Thus, our customized view lets you view your financial data just how you want, helping you quickly get an overview of your status at your fingertips.

Consolidated Report

We combine all kinds of financial data from all your financial institutions, including assets and investments, and put them in one place. Our tech-driven platform makes collecting and presenting the data on your preferred device easy and fast.

Performance Analysis

Our financial experts assist you in presenting an in-depth performance analysis report, including your historical returns, risk adjustments, and attribution analysis. This report allows you to gather your financial performance in a simplified and easy-to-understand manner.

Risk Assessment

Only a clear understanding of your financial performance allows you to provide insights about risk exposures. It helps identify potential vulnerabilities and take appropriate measures to rectify them in due time.

Simplify Your Financial Data Management Today

Discover how our platform can transform your financial data aggregation and wealth management reporting into a streamlined process that saves you time and improves decision-making. Let us help you centralize your financial activities for a complete, real-time view.